DIYWallST Weekly Recap & Market Forecast $SPX (June 22th—> June 27th)

Stock Market Outlooks, Earning Calendars, WallStreetBets, Economic Calendar, Stock Market Recap, $SPX, Crypto, BTC, DIY Investing

👋 Hello DIY Investors! 🌟

This week, geopolitical tensions and economic data took center stage, shaping market sentiment. As U.S.-Iran tensions escalated and Federal Reserve decisions remained in focus, investors navigated through some volatility. Let’s dive into the key market moves and developments:

📈 Market Overview: Geopolitics, Economic Data, and Fed Policy

This week, geopolitical risks emerged as a significant driver of market volatility, with U.S.-Iran tensions taking the spotlight. Despite a series of intense developments, markets showed some resilience, helped by U.S. economic data and a wait-and-see stance from the Fed.

Key Developments:

U.S.-Iran Tensions: The U.S. and Iran conflict ramped up, with President Trump considering military action, but talks between Iranian officials and the EU raised some hope for de-escalation. The VIX rose, while oil prices spiked due to fears of further conflict.

U.S. Economic Data: Economic readings showed weakness in May retail sales, housing starts, and jobless claims, putting a damper on market sentiment. However, PPI and CPI data remained within expectations.

Fed Decision: As expected, the FOMC kept interest rates on hold, maintaining a cautious wait-and-see stance. Chairman Powell acknowledged economic strength but highlighted tariff uncertainty as a key risk.

Market Performance:

S&P 500: -0.2%

DJIA: Flat

Nasdaq: +0.2%

📊 Economic Highlights:

Retail Sales: May retail sales underperformed, showing signs of slowing consumer spending.

Housing Starts: Housing data continued to show softness, with challenges around affordability impacting the market.

Jobless Claims: Elevated jobless claims suggest potential weakness in the labor market, though it remains resilient overall.

Fed Policy: The Fed left rates unchanged, with Powell signaling the likelihood of future rate cuts if economic uncertainty persists.

💼 Corporate News: Earnings and M&A Activity

This week saw notable earnings results, especially from tech and retail sectors, alongside significant M&A news.

Amazon (AMZN): CEO Andy Jassy highlighted AI's potential to reshape the workforce, with generative AI leading to corporate workforce reductions over time.

Jabil (JBL): Beat expectations and raised guidance on the back of strong demand for cloud and AI infrastructure products.

Lennar (LEN): Missed earnings estimates, citing affordability challenges as the key factor in weaker-than-expected home sales.

Kroger (KR): Reported strong earnings, announcing store closures to streamline operations amidst trade uncertainties.

Nippon Steel: Completed the acquisition of US Steel, creating a deal that gives the U.S. government the power to veto moving jobs or operations overseas.

Couchbase: Agreed to be acquired by private equity in a $1.5B deal.

🔮 Looking Ahead:

Next week, keep an eye on the following key events and earnings reports:

Here Are My #Top5ThingsToKnow This Week:

U.S.-Israel-Iran Tensions: Geopolitical risks are expected to continue affecting sentiment, especially with the potential impact on oil markets.

Fed Chair Powell Testimony: Powell’s remarks will be crucial in providing clarity on the Fed’s view on future rate cuts and economic outlook.

U.S. Core PCE Inflation: The Core PCE inflation report is critical for assessing price pressures and the Fed’s next move.

Earnings Reports: Watch for $NKE, $FDX, and $MU earnings, which will provide key insights into the health of the consumer and tech sectors.

Bank Stress Test Results: The results will shed light on the financial system’s resilience amid potential economic uncertainties.

💬 Question of the Week:

How do you think the ongoing U.S.-Iran tensions will impact global markets, especially oil and risk assets, in the short term?

👉 Join the discussion in Discord and share your thoughts!

📝 From the Editor

The U.S. has now officially entered the war with Iran by striking nuclear sites. This was sadly in line with what I expected last week. It’s heartbreaking, and my thoughts go out to all the lives lost in this escalating conflict.

From an investing standpoint, I think oil, gold, and defense stocks will continue to gain strength. But the truth is, things are getting scary. The uncertainty is heavy, and to be honest, I find myself staying a bit disconnected just to keep focused on the markets.

Stay alert.

– The DIYWallSt Team

Market Forecast (Updated 06/22/2025)

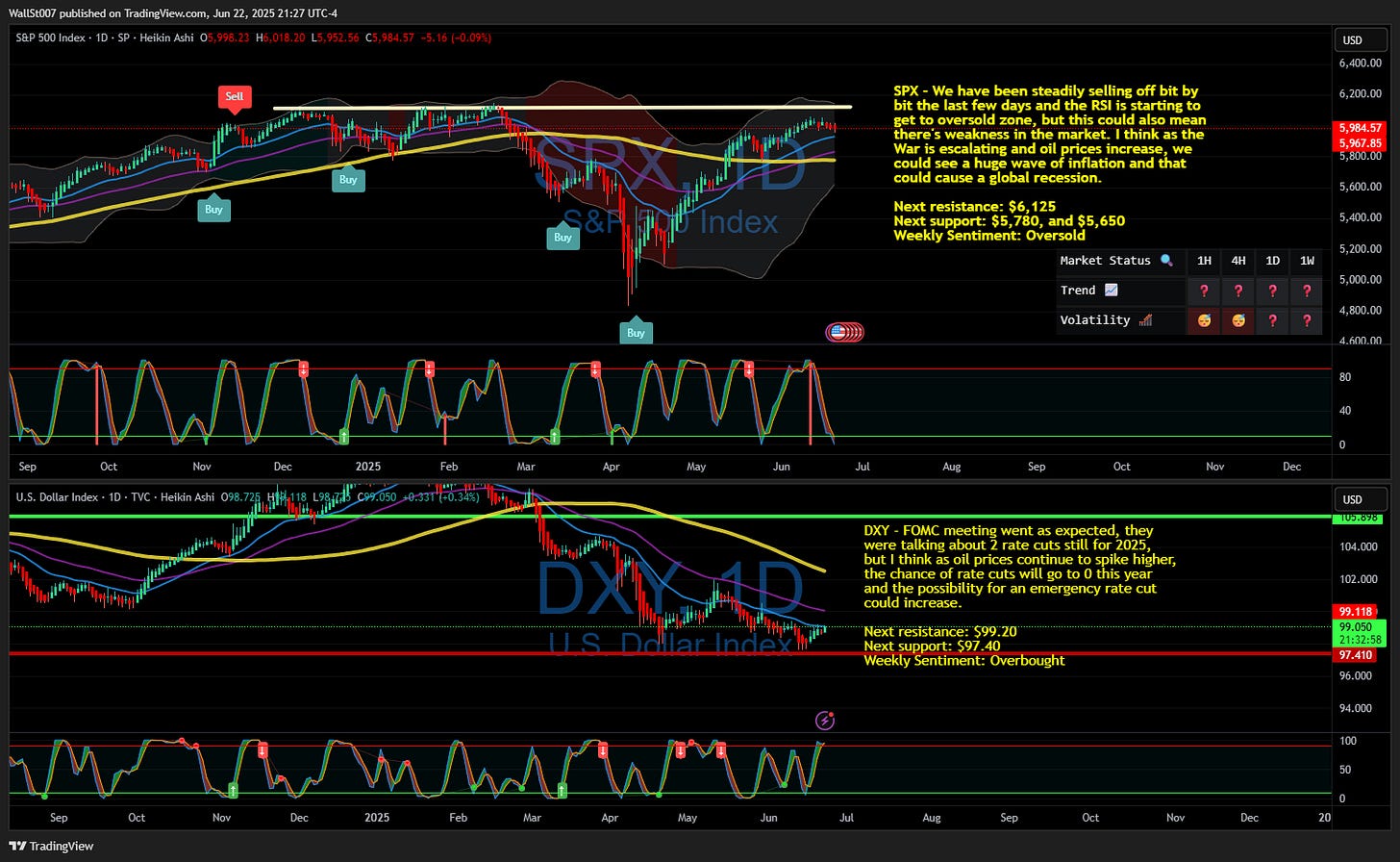

SPX - We have been steadily selling off bit by bit the last few days and the RSI is starting to get to oversold zone, but this could also mean there's weakness in the market. I think as the War is escalating and oil prices increase, we could see a huge wave of inflation and that could cause a global recession.

Next resistance: $6,125

Next support: $5,780, and $5,650

Weekly Sentiment: Oversold

Chart Analysis: TVC:DXY Chart Image by WallSt007

DXY - FOMC meeting went as expected, they were talking about 2 rate cuts still for 2025, but I think as oil prices continue to spike higher, the chance of rate cuts will go to 0 this year and the possibility for an emergency rate cut could increase.

Next resistance: $99.20

Next support: $97.40

Weekly Sentiment: Overbought

Put to call Ratio: 1.49—>1.26—> 1.74—>1.71 —>1.23

Next FOMC date: 07/29/2025

Fear & Greed Index: 64—>62—>63—>60—>55 (Under 25 is extreme fear)

BTC: I think it'll be really interesting to see how BTC reacts to things this week, if they continue to drop and break under the 95k support, that means we could see market follow in that bearish direction.

Next Major Resistance: 111k

Next Support: 95k and 77k.

BTC Chart: BINANCE:BTCUSD Chart Image by WallSt007

Undervalued Stock Watchlist(updated 6/15/2025): Stocks on our radar due to their potential value include: X10: ALLE, ATEC, CASH, CBRL, CIEN, DRVN, EVTC, EW, FBP, FHN, FVRR, LUV, MCO, MSGE, RIVN, VMC, ZWS, OKTA, UPWK, CDPYF, FMX, FRHC, GSK, MA, MGDDY, AZZ, BOE, CTRI, FVRR, NSRGY, RNW, SARO, SERV, SKYW

X20: EE, KNTK, OKE, LILA, WRD, HCKT, HSTM, KRYS, LNTH, MESO, OKE, PAGP, MDT, NKE, SBLK, G, CPRT, VERX

Swing Trading watchlist: Get a detailed view here.

Weekly Undervalued Stock Picks

LMT: Lockheed Martin Corp. is a global security and aerospace company, which engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services. It operates through the following business segments: Aeronautics, Missiles and Fire Control (MFC), Rotary and Mission Systems (RMS), and Space. The company was founded in 1995 and is headquartered in Bethesda, MD.

Buy: $471.25

Sell: $500

Stoploss: $442.50

MCO: Moody's Corp. engages in the provision of credit ratings, research, tools and analysis to the global capital markets. It operates through the Moody's Investors Service (MIS) and Moody's Analytics (MA) segments. The company was founded by John Moody in 1909 and is headquartered in New York, NY.

Buy: $366

Sell: $390

Stoploss: $342

Concentrix Corporation (NASDAQ: CNXC) is a global provider of customer experience (CX) solutions and technology. Headquartered in Newark, California, the company offers services such as customer engagement, business process outsourcing (BPO), analytics, and digital transformation. Concentrix serves clients across industries including technology, healthcare, finance, automotive, and retail

Buy: $50.50

Sell: $53.50

Stoploss: $47.50

Key Economic & Earnings Events for This Week: We moved this section to our trading corner that’s updated daily. 007ofWallSt Trading Corner

Quick Financial Glossary:

Overbought Sentiment: Imagine a product getting too popular, too fast. This might hint that its popularity could soon fade.

Oversold Market: Think of it as a fantastic product being ignored by many. Chances are, it'll soon catch everyone's eye and gain value.

Support: Picture it as a safety net under a trapeze artist. It's a level where a stock tends to stop falling, based on past performance.

Resistance: Think of this as a ceiling in a room. It's a level that a stock struggles to exceed, based on its history.

SPX (S&P 500 Index): This is like the leaderboard of the American stock market, showing the performance of 500 large companies listed on stock exchanges in the United States. It's often used as a thermometer for the overall health of the US stock market and economy.

DXY (US Dollar Index): Imagine it as a scorecard that tells us how strong the US dollar is compared to a basket of other currencies. It's like a report card for the US dollar's value on the global stage.