DIYWallST Weekly Recap & Market Forecast $SPX (June 8th—> June 13th)

Stock Market Outlooks, Earning Calendars, WallStreetBets, Economic Calendar, Stock Market Recap, $SPX, Crypto, BTC, DIY Investing

👋 Hello Investors! 🌟

From surprise central bank moves to a billionaire blowup, this week had it all. Stocks extended gains despite rising volatility around tariffs, tech earnings, and political infighting. The bulls stayed in control for now—pushing the S&P back to test the 6,000 level—but risks are simmering under the surface.

Let’s break down the action and what it means for your portfolio 👇

🌍 Market Overview: Tariffs, Central Banks, and Billionaire Beef

The week started on shaky ground after President Trump announced new tariffs on imported U.S. steel and aluminum, knocking stocks, bonds, and oil lower.

📌 Global Forces at Play:

OPEC+ left July production plans unchanged (+411K bpd), but Saudi Arabia reportedly wants even more “super-size” increases to capture market share.

The ECB cut rates again, signaling it’s nearing the end of its easing cycle. Meanwhile, India’s central bank slashed rates more than expected to stimulate growth.

U.S. yields fell midweek after disappointing ADP employment and ISM data, but bounced back on Friday’s stronger-than-expected May jobs report.

📈 S&P 500 retested 6K as the week closed, while:

VIX fell back below 18

10-year Treasury yields neared 4.5%

Crude oil found a bid

The dollar strengthened

🧾 Trade Talks & Political Turbulence:

Trump & Xi spoke, laying the groundwork for more high-level U.S.-China trade talks.

But the spotlight shifted fast to the dramatic Trump vs. Elon Musk feud, with Tesla shares plunging 10% Thursday after their war of words dominated headlines.

📊 Weekly Market Performance:

S&P 500: +1.5%

Dow Jones: +1.2%

Nasdaq: +2.2%

🧠 Economic Recap: Jobs Solid, But Caution Creeps In

May Jobs Report:

Strong headline payrolls (+), but…

Wages were hotter than expected

Participation rate dipped

April revisions moved lower

➜ Net result: More “wait-and-see” ammo for the Fed, but no urgency to cut.

Initial Jobless Claims:

Tick higher towards the 250K caution level, a marker economists are watching.

Oil & Bonds:

Oil rebounded despite OPEC+ supply overhang.

Bond yields climbed after job data, with the 2-year back to 4%.

Trump on Powell (again):

POTUS called the Fed Chair a “disaster”, demanding an immediate 100 bps cut.

💼 Corporate Highlights: Musk vs. Trump Overshadow Earnings Season’s Final Stretch

💥 Billionaire Brawl

Tesla ($TSLA):

Shares tanked more than 10% after Elon and Trump traded public jabs on X, Truth Social, and even TV.

→ Fallout hit Tesla and Trump Media stock alike.

📊 Earnings Rundown

Broadcom ($AVGO):

Despite AI optimism, in-line results disappointed; shares slid.

DocuSign ($DOCU):

Beat estimates, but cut billings guidance → profit taking ensued.

Crowdstrike ($CRWD):

Solid Q1, but weak Q2 guidance and analyst downgrades weighed on the stock.

🛍️ Retail Highlights

Five Below ($FIVE):

Strong quarter showed budget-conscious shoppers are fueling the value space.

Circle Internet IPO:

Latest ‘unicorn’ to go public soared 100%+ on debut—proof animal spirits aren’t dead yet.

🔭 What’s Coming Up Next:

Here Are My #Top5ThingsToKnowThisWeek:

🇺🇸 U.S.-China Trade Talks – Will they escalate, stall, or surprise?

🧮 CPI & PPI Inflation Reports – Key Fed-watch indicators drop next week.

🥊 Trump vs. Elon Musk – Will the feud cool off or heat up again?

💻 Earnings: $ORCL, $ADBE, $GME, $CHWY

🍏 Apple WWDC Event – Expect new AI features and maybe a hardware twist?

💬 Question of the Week:

Who’s got more market-moving power right now—Elon Musk or Jerome Powell?

👉 Drop your vote in Discord and let us know why!

Enjoy your weekend, stay sharp, and stay curious.

We’ll be back next week with another packed data slate and the WWDC buzz in full swing.

Until then, happy investing! 📈🚀

📝 From the Editor

Markets are pushing higher on strong economic data, but cracks in sentiment are showing again with Trump and Elon clashing online, and trade tensions in Asia still unresolved.

SPX is nearing the $6,120 resistance, with RSI looking toppy—expect possible hesitation or profit-taking at these levels.

Meanwhile, DXY is oversold as the U.S. eyes a massive spending bill, while other countries hit pause on rate cuts. Inflation looks mostly under control, but debt concerns could weigh on the dollar.

Trading Takeaway:

Watch for a potential SPX rejection near $6,120, especially if macro headlines stay chaotic. DXY could bounce if Fed tone firms up this week.

– The DIYWallSt Team

Market Forecast (Updated 06/08/2025)

SPX - Economic data points are coming in positive and driving the market up but uncertainty is back with Trump and Elon musk fighting online. Trade wars with Asia hasn't de-escalated much. RSI is getting a bit toppy and it'll be interesting to see how market reacts at 6120 area.

Next resistance: $6,120

Next support: $5,770, and $5,655

Weekly Sentiment: toppy

Chart Analysis: TVC:DXY Chart Image by WallSt007

DXY - The govt is trying to pass a huge spending bill that could increase our national debt, while EU and Canada is slowing down their rate cut. Inflation is almost under control.

Next resistance: $100.60

Next support: $97.40

Weekly Sentiment: Oversold

Put to call Ratio: 1.19—>1.49—> 1.26—>1.74

Next FOMC date: 06/17/2025

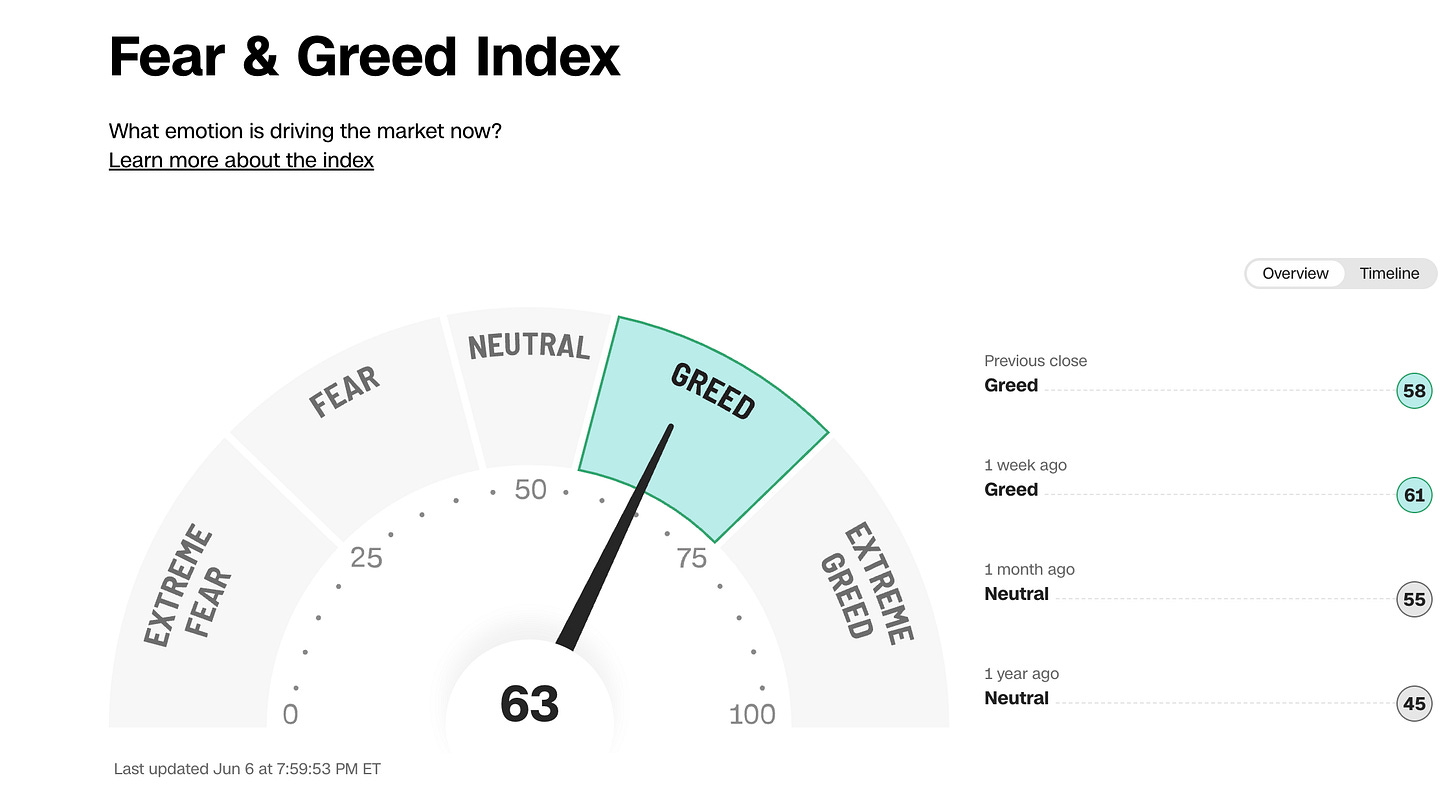

Fear & Greed Index: 71—>64—>62—>63 (Under 25 is extreme fear)

BTC:Bitcoin is at oversold zone again, and has busted through all our resistance so far. it has reunited with it's trend of following Gold and inversing the dollar again. If this continues we could see it touch 150k to 200k this year.

Next Major Resistance: 111k

Next Support: 95k and 77k

BTC Chart:BINANCE:BTCUSD Chart Image by WallSt007

Undervalued Stock Watchlist(updated 6/8/2025): Stocks on our radar due to their potential value include: X10: AGCO, ALB, BAC, BIPC, CADE, CBU, CPK, FCNCA, FFIN, FMBH, GOOG, GOOGL, GRC, IRM, KIM, NPO, NXRT, OBK, PB, PFS, PHG, RNST, UMBF, URI, WBS, WDC, WT, GLPG, IVBXF, LUCK, PGRE, PLYA, SNPMF, SBAC, GAIN, G

X20: EE, KNTK, OKE, LILA, WRD, HCKT, HSTM, KRYS, LNTH, MESO, OKE, PAGP, MDT, NKE, SBLK

Swing Trading watchlist: Get a detailed view here.

Weekly Undervalued Stock Picks

CPK: Chesapeake Utilities Corp. engages in the distribution and transmission of natural gas, propane and electricity, and the generation of electricity and steam. It operates through the Regulated Energy and Unregulated Energy segments. The Regulated Energy segment distributes and transmits gas, natural gas, and electricity. The Unregulated Energy segment markets and sells propane, crude oil, and natural gas. The company was founded in 1947 and is headquartered in Dover, DE.

Buy: $97

Sell: $105

Stoploss: $89

GOOGL: Alphabet, Inc. is a holding company, which engages in software, health care, transportation, and other technologies. It operates through the following segments: Google Services, Google Cloud, and Other Bets. The Google Services segment includes products and services, such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. The Google Cloud segment refers to infrastructure and platform services, collaboration tools, and other services for enterprise customers. The Other Bets segment relates to the sale of healthcare-related services and internet services. The company was founded by Lawrence E. Page and Sergey Mikhaylovich Brin on October 2, 2015 and is headquartered in Mountain View, CA.

Buy: $167.50

Sell: $178.50

Stoploss: $156.50

Academy Sports and Outdoors, Inc. (NASDAQ: ASO) is a U.S.-based sporting goods and outdoor recreation retailer. Headquartered in Katy, Texas, the company operates over 250 stores across the South and Midwest, offering products for sports, hunting, fishing, camping, and outdoor lifestyles. Academy also sells private-label and national brand merchandise through its retail locations and online store.

Buy: $43.25

Sell: $39.50

Stoploss: $47.00

Key Economic & Earnings Events for This Week: We moved this section to our trading corner that’s updated daily. 007ofWallSt Trading Corner

Quick Financial Glossary:

Overbought Sentiment: Imagine a product getting too popular, too fast. This might hint that its popularity could soon fade.

Oversold Market: Think of it as a fantastic product being ignored by many. Chances are, it'll soon catch everyone's eye and gain value.

Support: Picture it as a safety net under a trapeze artist. It's a level where a stock tends to stop falling, based on past performance.

Resistance: Think of this as a ceiling in a room. It's a level that a stock struggles to exceed, based on its history.

SPX (S&P 500 Index): This is like the leaderboard of the American stock market, showing the performance of 500 large companies listed on stock exchanges in the United States. It's often used as a thermometer for the overall health of the US stock market and economy.

DXY (US Dollar Index): Imagine it as a scorecard that tells us how strong the US dollar is compared to a basket of other currencies. It's like a report card for the US dollar's value on the global stage.