DIYWallST Weekly Recap & Market Forecast $SPX (July 27th—> August 1st)

Stock Market Outlooks, Earning Calendars, WallStreetBets, Economic Calendar, Stock Market Recap, $SPX, Crypto, BTC, DIY Investing

👋 Hello DIY Investors! 🌟

This week, equity markets continued their upward trajectory, with the S&P 500 and NASDAQ reaching fresh all-time highs amid growing optimism around trade and reassuring earnings commentary. While U.S.-Japan trade talks and corporate earnings were key drivers, macroeconomic data painted a mixed picture. The market sentiment was largely shaped by the trade deal progress and the ongoing Fed policy debate.

Let’s break down the key events and market moves this week:

📈 Market Overview: Trade Deals, Earnings, and Fed Policy

This week, market focus shifted between trade developments, particularly the U.S.-Japan trade agreement, and economic data, which highlighted both strengths and challenges. Despite some mixed earnings reports, the market continued to rally as investors found comfort in the trade progress and economic resilience.

Key Developments:

U.S.-Japan Trade Agreement: The U.S. and Japan reached a trade deal that lowered automotive tariffs from 25% to 15%, with Japan agreeing to invest $550B into the U.S. in a new partnership. While some details remain unclear, the agreement boosted market sentiment and raised hopes for similar deals with the EU and South Korea as the August trade deadline approaches.

Economic Data: Richmond Fed manufacturing data showed significant deceleration, especially in new orders. The S&P PMI also pointed to weakening manufacturing, while services remained stronger. Jobless claims continued their downward trend, marking the sixth straight week of decline, indicating resilience in the labor market.

Fed Policy: President Trump continued to push the Fed to cut rates, even visiting the Fed's DC building renovations. However, Fed officials have remained cautious, maintaining their wait-and-see stance. The FOMC meeting next week will be key in determining the Fed's direction.

Market Performance:

S&P 500: +1.5%

DJIA: +1.3%

Nasdaq: +1%

📊 Economic Highlights:

Inflation: The June CPI data showed inflation remained above target, with core goods prices rising to a two-year high. However, the PPI was cooler than expected, which provided some relief.

Housing Data: Existing and new home sales showed ongoing challenges for the housing market, largely driven by affordability issues and tariffs.

Trade Impact: The ongoing trade tensions and tariffs continue to weigh on companies, particularly in the manufacturing and tech sectors, with companies like Tesla and GM forecasting challenges ahead.

💼 Corporate News: Earnings and Trade Impact

This week saw big tech names post rocky earnings reports, while other sectors, particularly automotive and chemicals, reported ongoing challenges due to the trade war and tariffs.

Intel (INTC): Missed earnings expectations as the new CEO scrapped some major projects in Germany and Poland due to trade uncertainties.

Alphabet (GOOGL): Beat expectations but raised concerns over weak free cash flow, a theme across many companies this quarter.

Tesla (TSLA): Withdrew production guidance due to tariff impacts and the end of U.S. tax credits, and Elon Musk predicted “a few rough quarters” ahead.

General Motors (GM): Beat analyst estimates but warned about the impact of tariffs on Q3 earnings.

Dow Inc. (DOW): Missed earnings and halved its dividend due to tariff impacts and a challenging macroeconomic environment.

Puma: Cut FY25 guidance sharply, citing U.S. tariffs as a major headwind.

M&A Activity: Union Pacific is reportedly exploring a deal with Norfolk Southern, while Paramount received FCC approval for a $3.1B acquisition by Skydance.

🔮 Looking Ahead:

Next week, keep an eye on the following key events and earnings reports:

Here are things to watch out for this week:

Trump Trade Deadline: The August 1st tariff deadline remains a key risk, with tariff announcements potentially escalating tensions further.

Fed Rate Decision: Chairman Powell’s remarks will be critical in shaping expectations for future rate cuts.

U.S. Jobs Report: The July employment report will be key in assessing the health of the labor market and its impact on Fed policy.

Tech Earnings: $MSFT, $AAPL, $META, and $AMZN earnings will provide crucial insight into the tech sector’s resilience and growth outlook.

💬 Question of the Week:

With trade tensions still simmering and Fed policy in focus, how do you think these factors will influence market sentiment in the second half of 2025? Will AI and tech stocks continue to lead, or will tariffs and geopolitical risks create headwinds for growth?

👉 Join the discussion in Discord and share your thoughts!

📝 From the Editor

This is shaping up to be one of the biggest weeks of the quarter. We’ve got a packed schedule with major tech earnings, a Fed decision, and potential tariff updates all on deck.

How the data plays out will likely drive big market moves — so stay nimble and be ready.

– The DIYWallSt Team

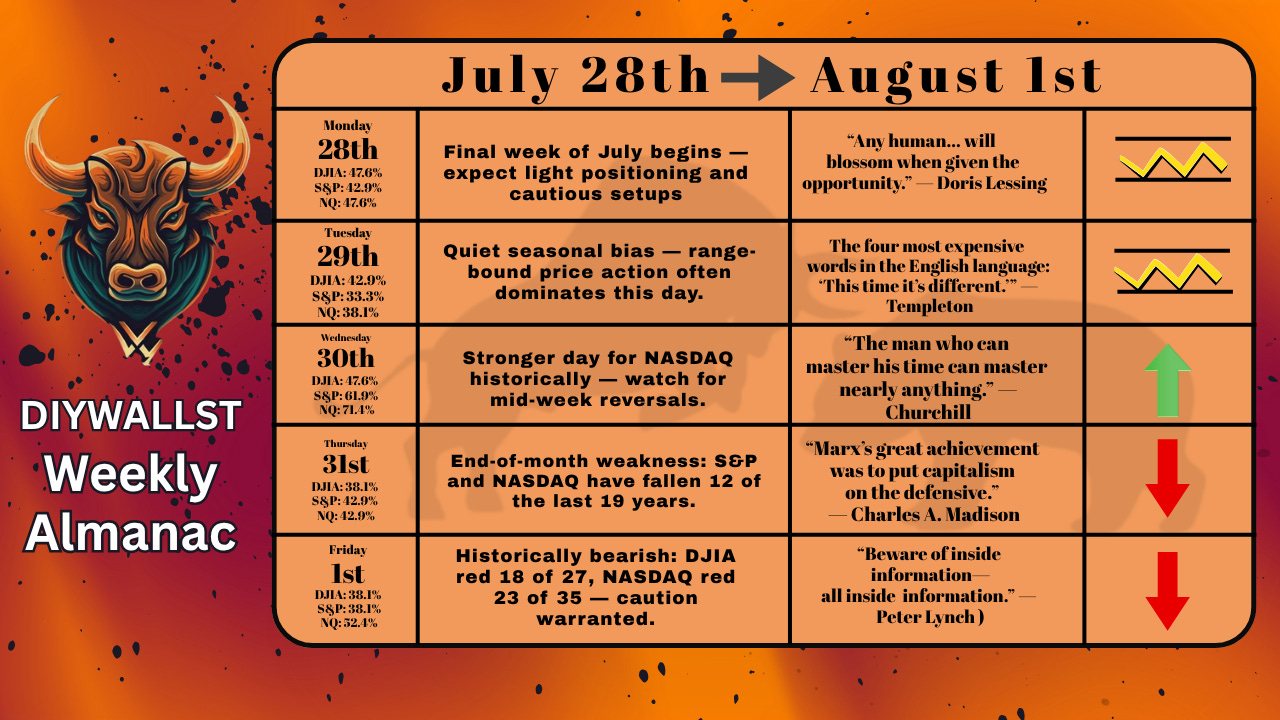

Market Forecast (Updated 07/27/2025)

SPX -This will probably be one of the biggest weeks this quarter as we have a lot of tech earnings, fed decisions and tariff decisions on the table. depending on how the data play out, we could see big moves.

Next resistance: $6,405, and 6,485

Next support: $6,290, and $6,120

Weekly Sentiment: Cross up from oversold.

Chart Analysis: TVC:DXY Chart Image by WallSt007

DXY - The dollar index came back down as expected, with FOMC meeting coming up, we could see some strength as long as there is no major cuts to the interest rates.

Next resistance: $98.50

Next support: $95.40

Weekly Sentiment: Oversold

Put to call Ratio: 1.36 —> 1.51 —>1.53 —> 1.48 —> 1.65

Next FOMC date: 07/29/2025

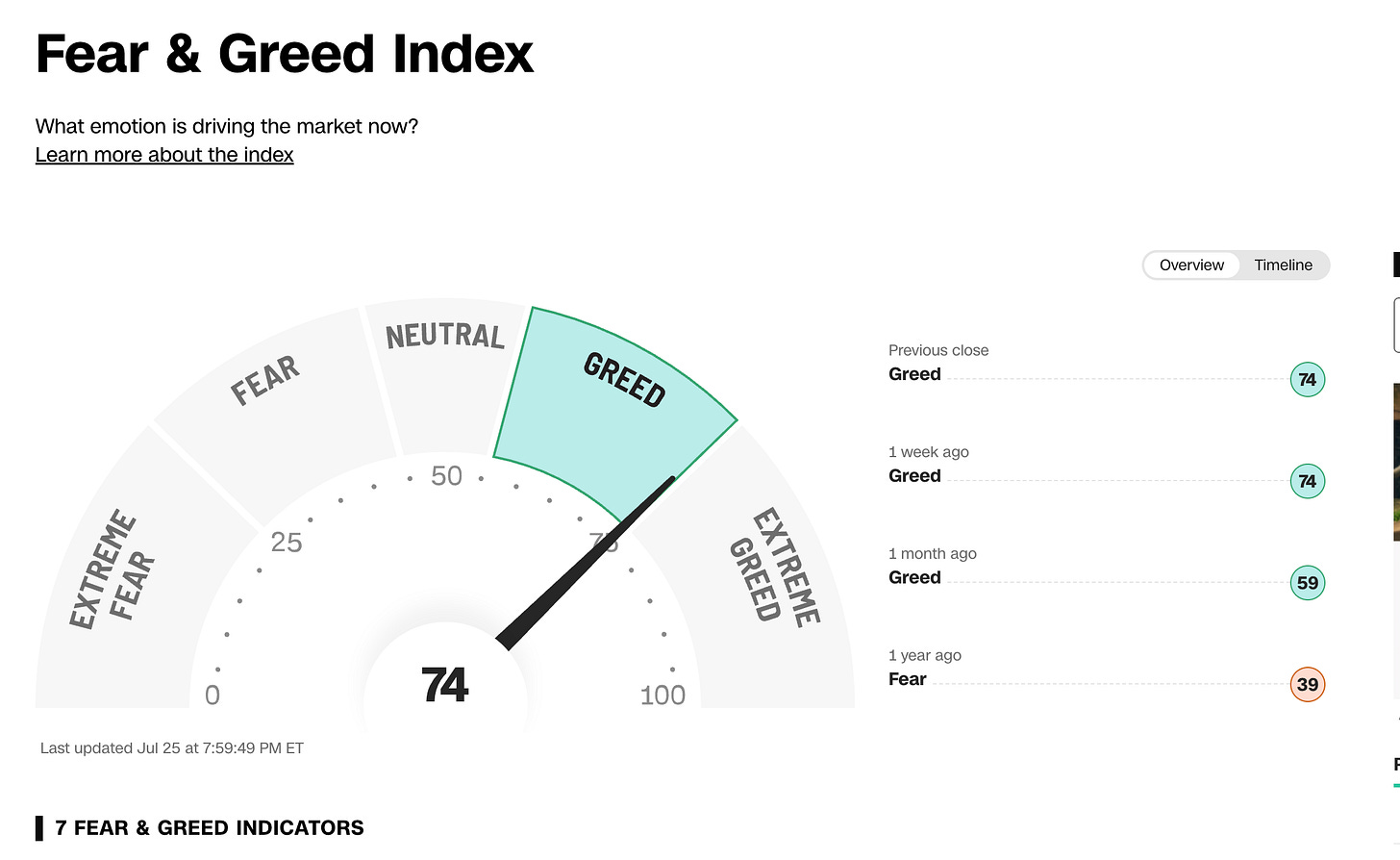

Fear & Greed Index (Under 25 is extreme fear): 65 —>78—>75—>75 —>74

Bia’s Note: we have been in the same zone of fear and greed index for the last few weeks now, I think we'll continue to be in greed until small caps and Dow Jones index makes a new ATH.

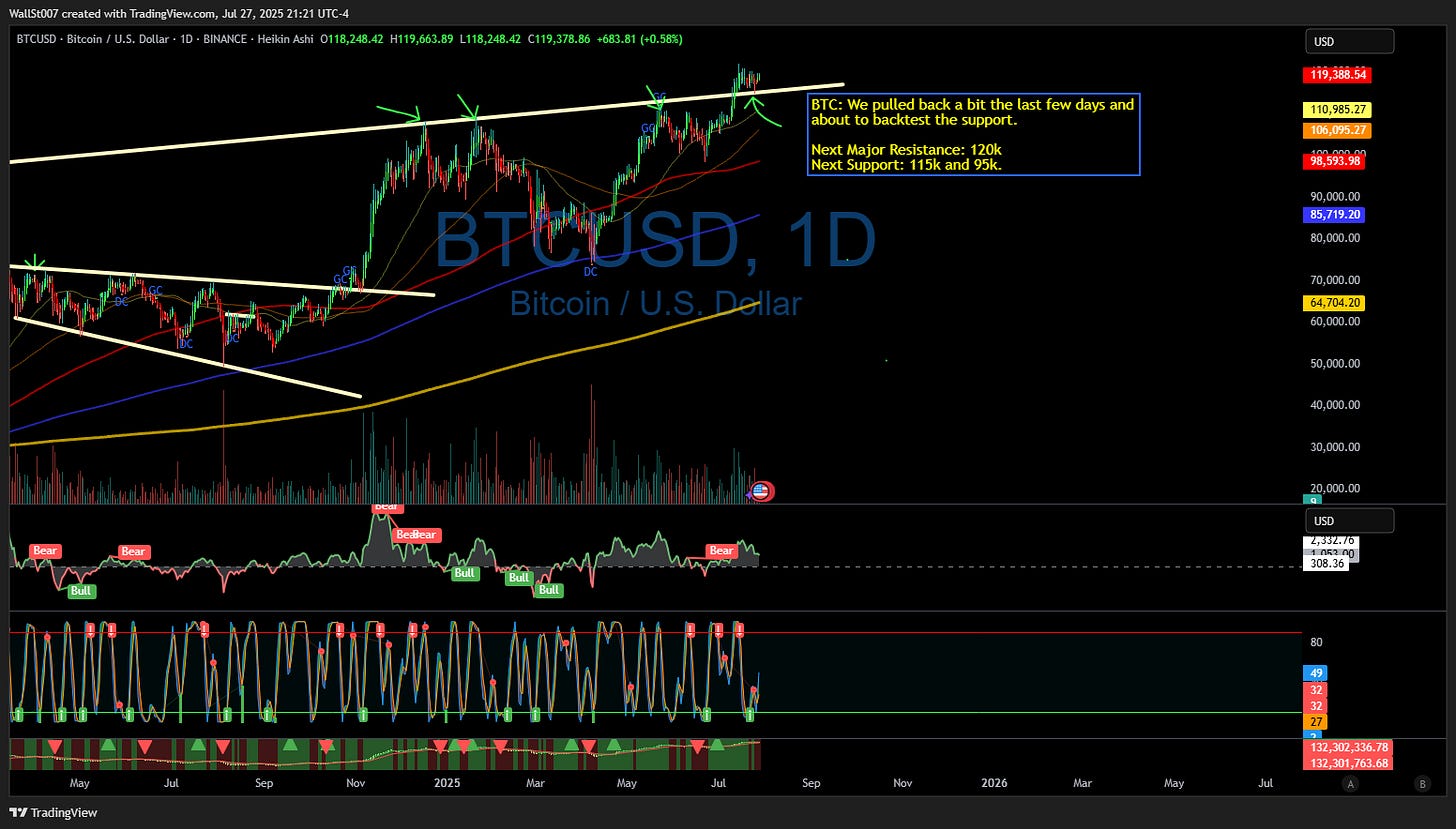

BTC: We tested the support near 115k area and it seems to be holding so far.

Next Major Resistance: 125k

Next Support: 115k and 95k.

BTC Chart: BINANCE:BTCUSD Chart Image by WallSt007

Stock picks this week

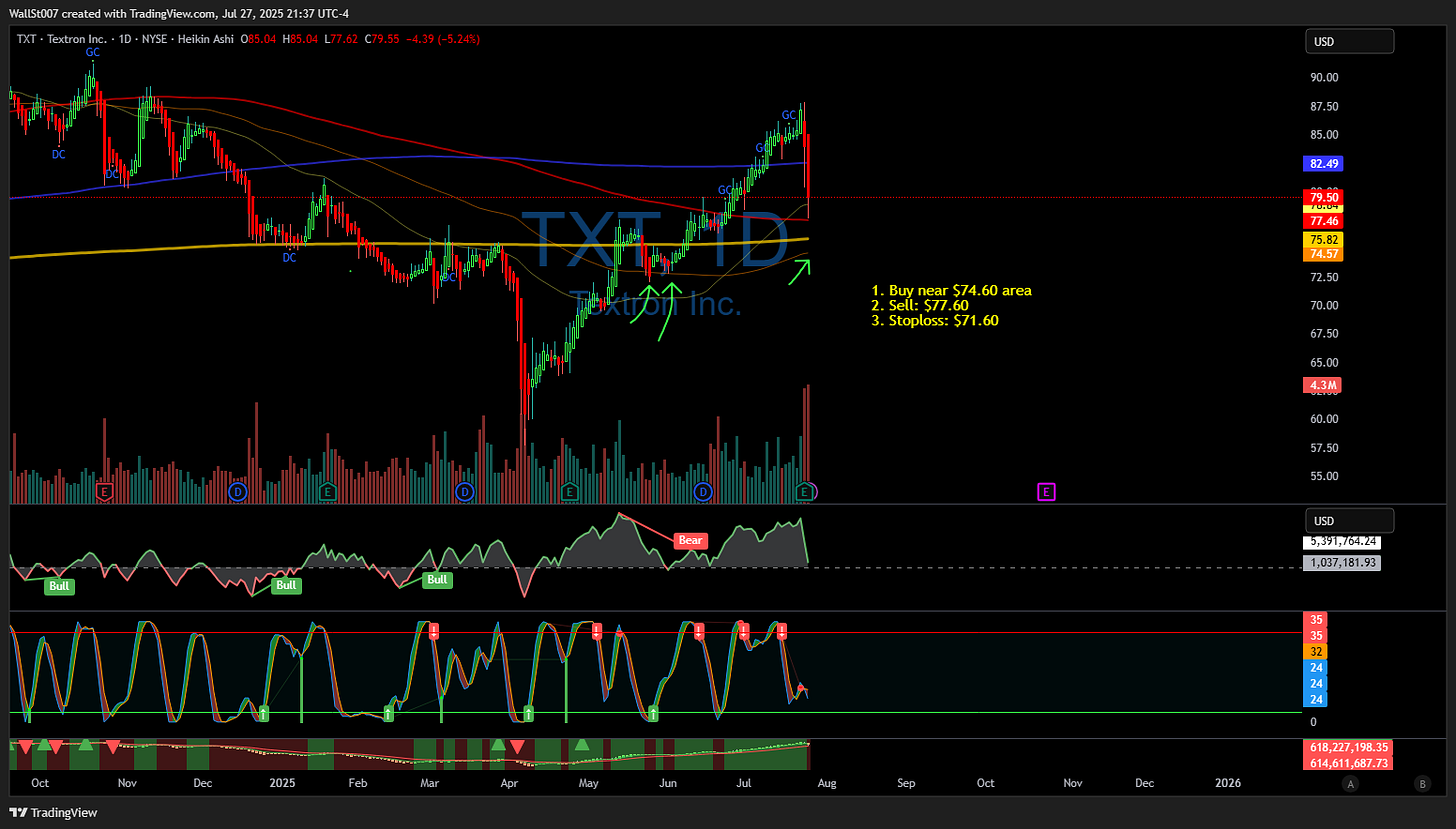

TXT- Textron, Inc. is a multi-industry company, which leverages a global network of aircraft, defense, industrial, and finance businesses to customers. It operates through the following segments: Textron Aviation, Bell, Textron Systems, Industrial, Textron eAviation, and Finance. The Textron Aviation segment manufactures, sells, and services Beechcraft and Cessna aircraft. The Bell segment supplies military and commercial helicopters, tiltrotor aircraft, and related spare parts. The Textron Systems segment develops, manufactures, and integrates a variety of products and services for United States and international military.

Buy near $74.60 area

Sell: $77.60

Stoploss: $71.60

GME GameStop Corp. engages in offering games and entertainment products through its ecommerce properties and stores. The firm's stores and ecommerce sites operate primarily under the names GameStop, EB Games, and Micromania. It operates through the following geographical segments: United States, Canada, Australia, and Europe.

Buy near $22.75

Sell: $24.75

Stoploss: $20.75

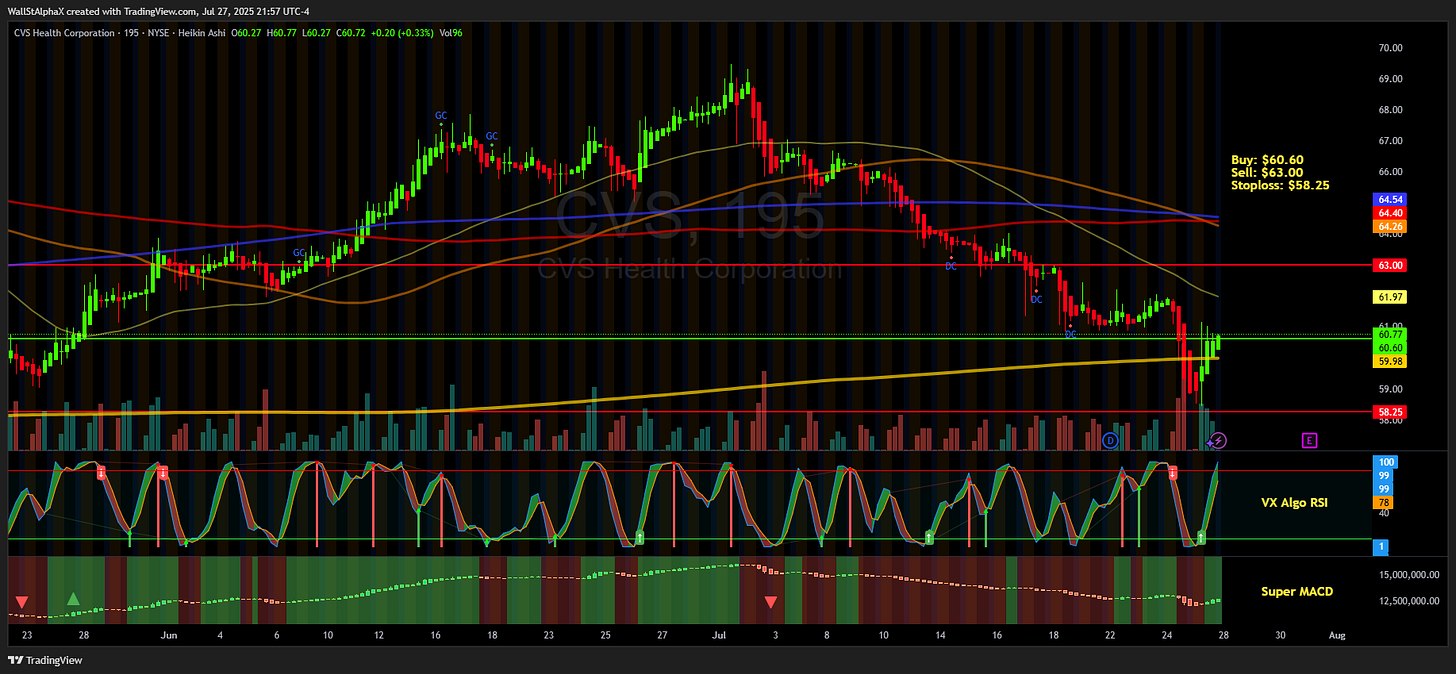

CVS Health Corporation (NYSE: CVS) is a leading U.S. healthcare company that operates a large network of pharmacies, retail clinics, and health insurance services. Headquartered in Woonsocket, Rhode Island, its core businesses include CVS Pharmacy, CVS Caremark (pharmacy benefits), and Aetna (health insurance). CVS focuses on integrated healthcare delivery, aiming to improve access, affordability, and outcomes for patients nationwide.

Buy near $60.60 area

Sell: $63.00

Stoploss: $58.25

Resources: Undervalued Stock Watchlist(updated 7/27/2025): Stocks on our radar due to their potential value include: X10: ADEA, BJRI, CPF, EQNR, EQT, FCF, FULT, LEA, MKSI, NTGR, PDX, PRK, SITM, SNV, TXT, UVSP, VRTS, GSHD, INTA, CRK, FCFS

Swing Trading Portfolio & Watchlist pick: https://007ofwallst.notion.site/19d416fd1563800aac49e583a7d7766d?v=19d416fd1563818e9af9000c4eb1d061&pvs=74

Key Economic & Earnings Events for This Week: We moved this section to our trading corner that’s updated weekly https://007ofwallst.notion.site/007ofWallSt-Trading-Corner-6b398b136e334741b12786424d208829?pvs=74

Quick Financial Glossary:

Overbought Sentiment: Imagine a product getting too popular, too fast. This might hint that its popularity could soon fade.

Oversold Market: Think of it as a fantastic product being ignored by many. Chances are, it'll soon catch everyone's eye and gain value.

Support: Picture it as a safety net under a trapeze artist. It's a level where a stock tends to stop falling, based on past performance.

Resistance: Think of this as a ceiling in a room. It's a level that a stock struggles to exceed, based on its history.

SPX (S&P 500 Index): This is like the leaderboard of the American stock market, showing the performance of 500 large companies listed on stock exchanges in the United States. It's often used as a thermometer for the overall health of the US stock market and economy.

DXY (US Dollar Index): Imagine it as a scorecard that tells us how strong the US dollar is compared to a basket of other currencies. It's like a report card for the US dollar's value on the global stage.