DIYWallST Weekly Recap & Market Forecast $SPX (May 18th—> May 23th)

Stock Market Outlooks, Earning Calendars, WallStreetBets, Economic Calendar, Stock Market Recap, $SPX, Crypto, BTC, DIY Investing

👋 Hello DIY Investors!

Markets roared back to life this week, snapping out of their recent slump as optimism returned on both the trade and inflation fronts. A landmark de-escalation in the U.S.-China trade war, along with softer-than-feared inflation readings, boosted investor confidence and sent key indices surging above technical resistance levels. Meanwhile, the White House struck a $2T economic pact in the Middle East, giving bulls even more to cheer about.

Let’s unpack the momentum behind this rally. 🚀

🌍 Market Overview: Trade Peace, Tame Inflation, and Tech-Led Rebound

Investors came into the week with cautious optimism, but the tone quickly shifted after the U.S. and China announced significant reciprocal tariff reductions during high-level talks in Geneva. In exchange for a 90-day negotiation window, China agreed to cut non-tariff barriers and commit to new U.S. purchase agreements. Risk assets responded in kind:

📉 The VIX dropped below 20

💰 Gold sold off

📈 Yields rose as traders priced out aggressive Fed rate cuts

📍 The momentum held all week, aided by:

A $2T investment pledge from the President’s Middle East trip

Signs that a reconciliation tax bill is moving in Congress—though SALT deduction caps remain a sticking point

💡 Inflation & Macro Check:

April CPI declined m/m with little sign of tariff pass-through… yet

Core goods inflation eased to just under 0.1%

PPI came in soft, though offset by prior month revisions

Retail sales beat expectations, but no signs of pre-tariff stockpiling

🛢️ Crude oil prices dipped on reports that Iran is ready to sign a nuclear deal with the U.S., potentially easing energy supply concerns.

📊 Weekly Market Performance:

S&P 500: +5.25%

Nasdaq: +7.2%

Dow Jones: +3.4%

📊 Economic Highlights:

Trade Truce: A major breakthrough in U.S.-China relations with both sides reducing tariffs and launching a 90-day negotiation period.

Inflation: April CPI and PPI were benign; early tariff impacts not yet visible.

Treasury Market: Yields rose early in the week, then eased as data softened.

Oil: Fell below $60 as Iranian deal headlines hit.

Fed Watch: Traders now expect only two rate cuts in 2025.

💼 Corporate Earnings & Headlines:

🛍️ Retail & Consumer:

Walmart ($WMT): Beat Q1 expectations but withheld full Q2 guidance, citing cost uncertainty from tariffs.

American Eagle ($AEO): Withdrew FY guidance—shares sank double digits.

Dick’s ($DKS): Announced a $5.4B acquisition of Foot Locker, offering an 85% premium.

🛠️ Industrial & Agriculture:

Deere ($DE): Strong quarter, but reduced FY guidance due to trade policy risks.

💾 Tech & AI:

Cisco ($CSCO): Beat expectations, driven by strength in AI infrastructure demand.

CoreWeave ($CRWV): Revenue exceeded estimates, though it missed on EPS. Demand remains strong despite macro headwinds.

🧬 Healthcare & Insurance:

UnitedHealth ($UNH): Announced CEO resignation and suspended FY guidance; DOJ reportedly investigating Medicare billing practices.

📱 Big Tech:

Apple ($AAPL): Rumored to be considering iPhone price hikes due to continued China dependency.

Coinbase ($COIN): Jumped on news it will join the S&P 500 Index—a milestone for crypto’s legitimacy.

📺 Telecom & Media:

Charter Communications ($CHTR): Announced merger with Cox Communications in a $34.5B cash-stock deal.

🔮 Looking Ahead: What to Watch Next Week

Markets are watching to see if the rally sticks. The focus shifts to housing data, credit rating news, and a fresh slate of retail earnings.

🗓️ Top 5 Things to Know:

🇺🇸 Moody’s U.S. Credit Downgrade Watch

📦 Trade Deal Developments

🏠 U.S. Housing Data

🎙️ Fed Speakers on the Circuit

💰 Earnings Highlights:

Home Depot ($HD), Target ($TGT), Lowe’s ($LOW), TJX ($TJX), Deckers ($DECK)

💡 Investor Takeaway

With the S&P back above its 200-day moving average and trade tensions easing (for now), bulls have room to breathe—but macro crosscurrents remain strong. Stay nimble and watch how inflation, credit risk, and global negotiations evolve.

📈 Need trade ideas and catalyst previews? Don’t forget to check the Trading Corner for upcoming events, earnings snapshots, and technical setups.

🗳️ This Week’s Investor Poll:

If the China deal sticks, will tech stocks lead the next leg higher—or is the market too far ahead of earnings?

Vote in Discord or reply directly to this newsletter!

Let’s keep leveling up together. 💪

Until next time—happy investing!

📝 From the Editor

The market feels like it’s running on fumes right now. Just a month ago, tariffs nearly broke it—and now we’re suddenly back near all-time highs. It feels surreal.

This week’s rally was driven by two headlines: a surprise Trade Peace announcement and a sudden drop in inflation readings. Tech stocks ripped higher, dragging the whole market up with them.

But don’t get too comfortable—VX Algo RSI is flashing overbought, and we’re likely due for some profit-taking soon. Stay sharp.

– The DIYWallSt Team

Market Forecast (Updated 5/18/2025)

SPX - Trade Peace was announced this week, and inflation sudden came under control. Tech stock rallied really hard as well and pushed market back to almost all time highs. However, the VX algo rsi is really toppy now and we could see profit taking soon.

Next resistance: $5,976 and $6,105

Next support: $5,775, and $5,655

Weekly Sentiment: Overbought

Chart Analysis: SP:SPX Chart Image by WallSt007

DXY - Inflation is coming down, Tariff is gone and feds are buying up bonds. We could potentially see the dollar rise again as we have higher interest rate than most countries.

Next resistance: $101.90

Next support: $97.40

Weekly Sentiment: Oversold

Put to call Ratio: 1.70—>1.05—> 1.19

Next FOMC date: 06/17/2025

Fear & Greed Index: 43—>62—>71 (Under 25 is extreme fear)

BTC: Bitcoin is starting to get overbought here at this zone and with the dollar pushing up again due to interest rate hold, we should see some weakness in btc soon.

Next Major Resistance: 108k

Next Support: 94k and 77k.

BTC Chart: BINANCE:BTCUSD Chart Image by WallSt007

Undervalued Stock Watchlist(updated 5/18/2025): Stocks on our radar due to their potential value include: X10: AGCO, ALB, BAC, BIPC, CADE, CBU, CPK, FCNCA, FFIN, FMBH, GOOG, GOOGL, GRC, IRM, KIM, NPO, NXRT, OBK, PB, PFS, PHG, RNST, UMBF, URI, WBS, WDC, WT

X20: EE, KNTK, OKE, PAA, LILA, WRD, G, HCKT, HSTM, KRYS, LNTH, MESO, OKE, PAGP, MDT, NKE, SBLK. WMK

Swing Trading watchlist: Get a detailed view here.

Weekly Undervalued Stock Picks

Weis Markets, Inc. (NYSE: WMK) is a U.S.-based regional grocery store chain headquartered in Sunbury, Pennsylvania. The company operates over 190 stores across the Mid-Atlantic region, offering fresh produce, meat, bakery items, pharmacy services, and private-label products. Weis focuses on providing affordable, community-focused supermarket services with an emphasis on quality and local sourcing.

Buy: $67

Sell: $73

Stoploss: $61

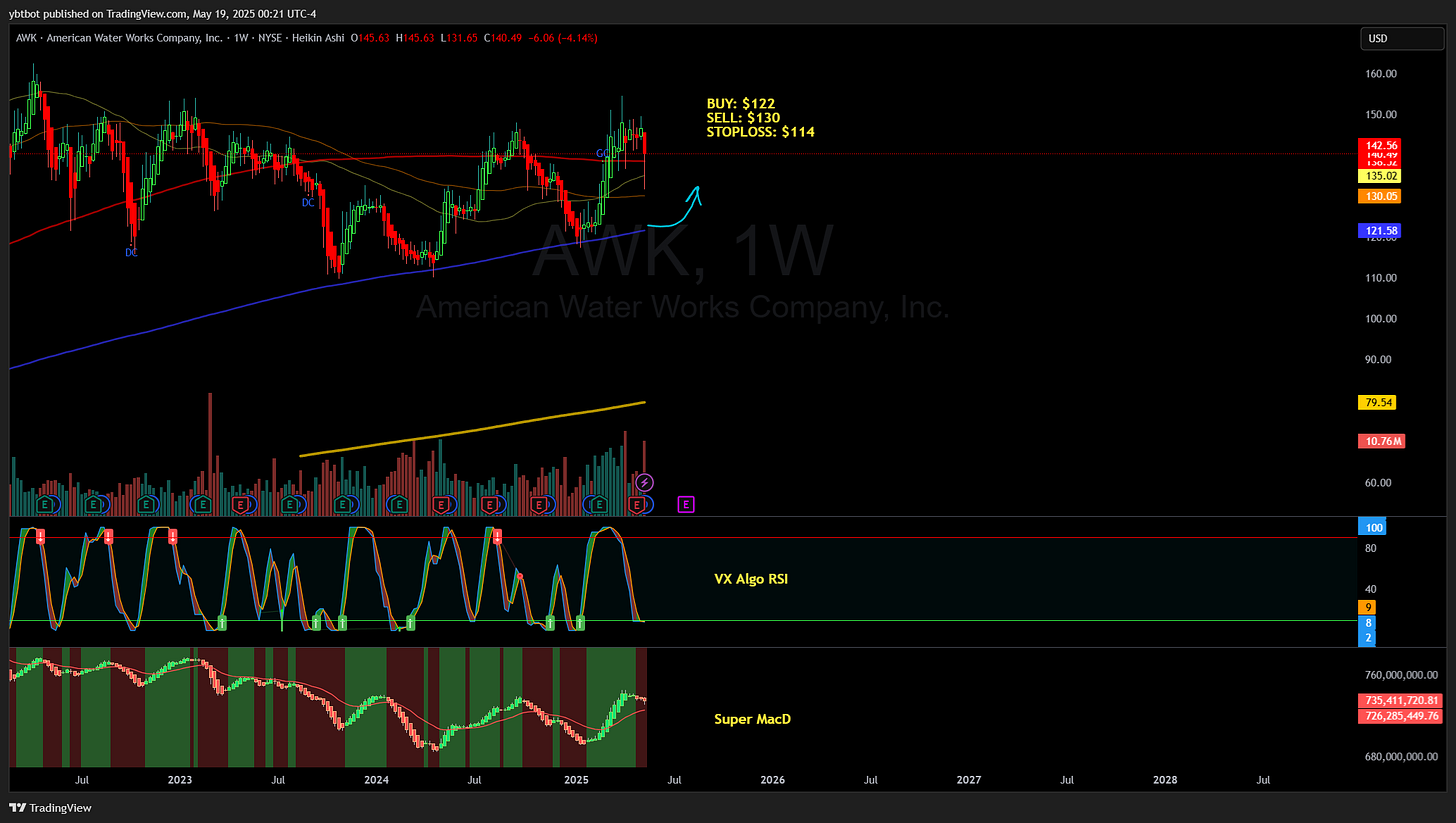

American Water Works Company, Inc. (NYSE: AWK) is the largest publicly traded water and wastewater utility company in the United States. Headquartered in Camden, New Jersey, it provides water and wastewater services to residential, commercial, and industrial customers across more than a dozen states. The company focuses on regulated operations, ensuring reliable and safe water infrastructure and services.

Buy: $122

Sell: $130

Stoploss: $114

Baidu, Inc. (NASDAQ: BIDU) is a leading Chinese technology company specializing in internet-related services, artificial intelligence, and autonomous driving. Headquartered in Beijing, Baidu operates China’s dominant search engine and offers products like Baidu Maps, Apollo autonomous driving platform, and Ernie AI models. The company is a major player in China’s push toward AI-driven innovation and smart transportation.

Buy: $88.80

Sell: $95.00

Stoploss: $ 82.60

Key Economic & Earnings Events for This Week: We moved this section to our trading corner that’s updated daily. 007ofWallSt Trading Corner

Quick Financial Glossary:

Overbought Sentiment: Imagine a product getting too popular, too fast. This might hint that its popularity could soon fade.

Oversold Market: Think of it as a fantastic product being ignored by many. Chances are, it'll soon catch everyone's eye and gain value.

Support: Picture it as a safety net under a trapeze artist. It's a level where a stock tends to stop falling, based on past performance.

Resistance: Think of this as a ceiling in a room. It's a level that a stock struggles to exceed, based on its history.

SPX (S&P 500 Index): This is like the leaderboard of the American stock market, showing the performance of 500 large companies listed on stock exchanges in the United States. It's often used as a thermometer for the overall health of the US stock market and economy.

DXY (US Dollar Index): Imagine it as a scorecard that tells us how strong the US dollar is compared to a basket of other currencies. It's like a report card for the US dollar's value on the global stage.